TCS Full Form Is Tax Collected at Source, TCS is tax that is payable by the seller, which is collected from the buyer.

In This Post You Will Learn “How To Record TCS Tax Transaction In Tally Prime Step By Step Guide.

TCS Rate and Section 206C of the Income Tax Act Mention?

Section 206C of the Income Tax Act, 1961 covers goods on which sellers must collect TCS (Tax Collected at Source) from their purchaser. However, it is only applicable for specified goods. It includes scrap, alcohol for human consumption, forest produce, minerals like coal and iron ore, timber, and tendu leaves.

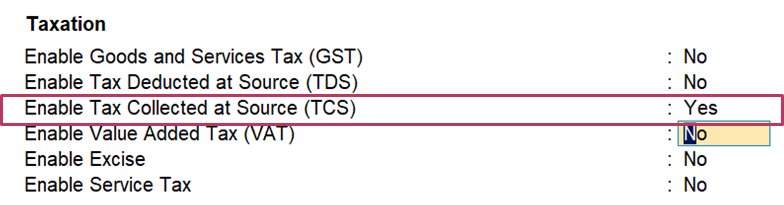

Step 1 Enable TCS In Tally Prime By Press F11 Key

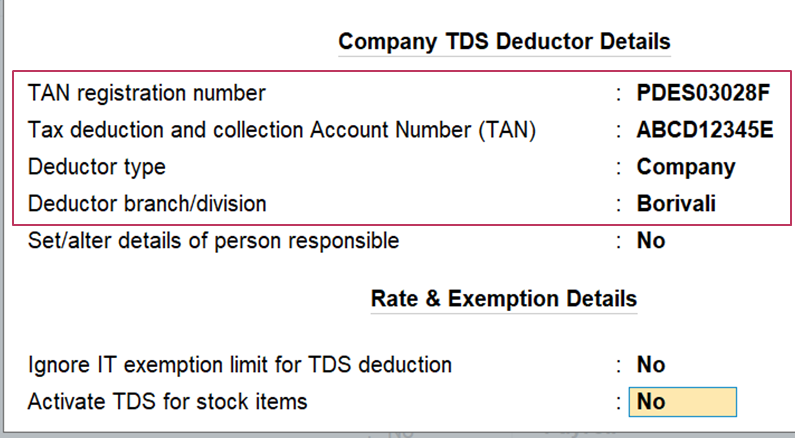

Step 2 Set TCS Details As Enable Tax Deducted At Source (TDS), Here Fill These Details Like This

Tan No: PDES03028F

Tax Deduction and Collection A/c No: ABCD12345E

Deductor Type: Company

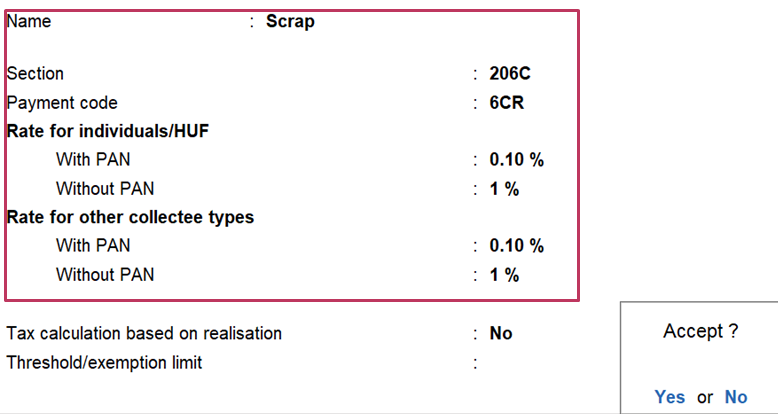

Step 3. Create “TCS Nature Of Goods Scrap

Gateway Of Tally >> Create >> TCS Nature Of Goods >> Create

Step 4. Create Following Ledger

Gateway Of Tally >> Create >> Ledger

1. Shubham Pvt Ltd Under Sundry Debtor

2. TCS On Sale Under Duties and Taxes

3. Sales A/c Under Sales Account

1. Shubham Pvt Ltd Under Sundry Debtor

2. TCS On Sale Under Duties and Taxes

3. Sales Ledger Creation Sales A/c

Step 5. Pass Sales Voucher

Gateway Of Tally >> Vouchers >> Sales