In This Tutorials Shows How To Calculate Simple Interest In Tally Prime. Interest is a legitimate return on money invested and chargeable in the business world on loans and also on delayed payments. Interest can be calculated on the basis of Simple or Compound Interest.

Step 1 Enable Interest Calculation Features In Tally Prime by Pressing F11 Key.

Step 2 Create / Alter A Ledger and Enable Activate interest calculation.

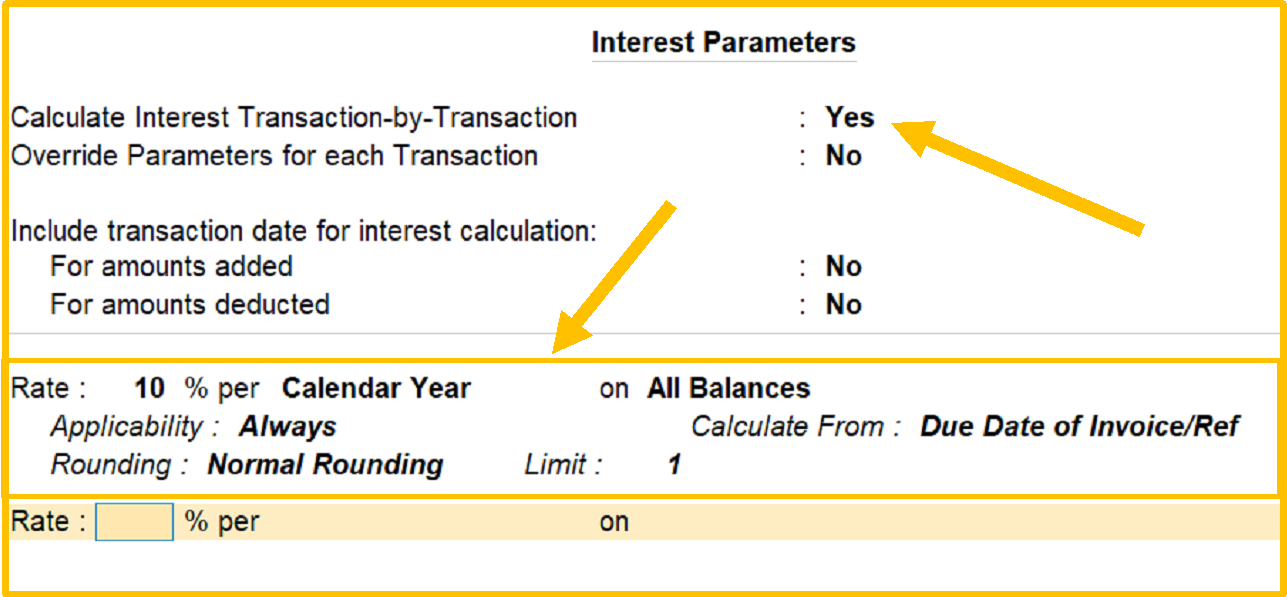

Step 3 Interest Parameter Setting

In this Tutorial Suppose Interest Will Apply 10% Yearly After Payment Due Date When Any Party Crossed His Payment Date, Then We will Charge @ 10% Yearly as Interest or (According to your Companies / Farm Rules).

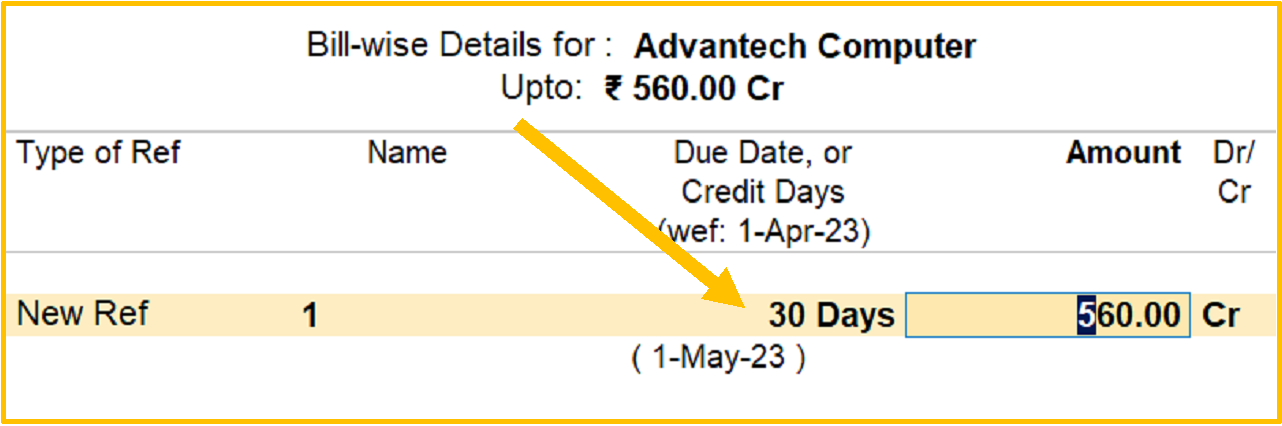

Step 4 Company Purchase Following Item on Credit 30 days

Purchase Date 01-04-23

Credit Days 30

Due Date 01-05-23

Step 5 Due Date or Credit Days Setup (30 Days) – according to your requirement

Balance sheet

Company didn’t pay their amount till 02-11-23 due any reason , so here interest will be applied from 02-05-23 to 02-11-23.

See Interest Report

GOT >> Display More Report >> Statement of Account >> >> Interest Calculation >> Interest Payable >> F2 > Choose Period

Interest Report

Step 6 Pass Credit Note Voucher (ALT + F6) Against Interest Amount to Party Account

- Credit Note Voucher Date – 02-11-23

- Voucher Mode –

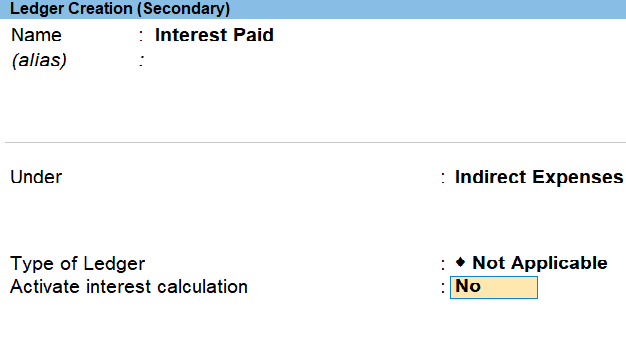

- Ledger Name Interest Paid Under Indirect Expense

Ledger Creation (Interest Paid)

Note : Open Credit Note Voucher and Press CTRL + H to change Voucher Mode –

Set up Reference

Credit Note will be like some thing this

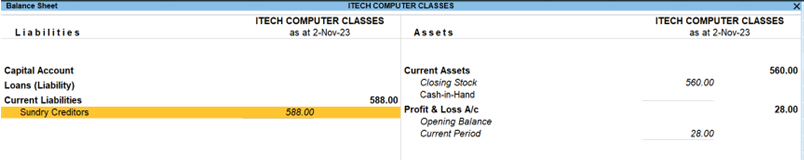

Balance Sheet After Credit Note You will be showed interest amount added into part account and your Liabilities will be Increased.

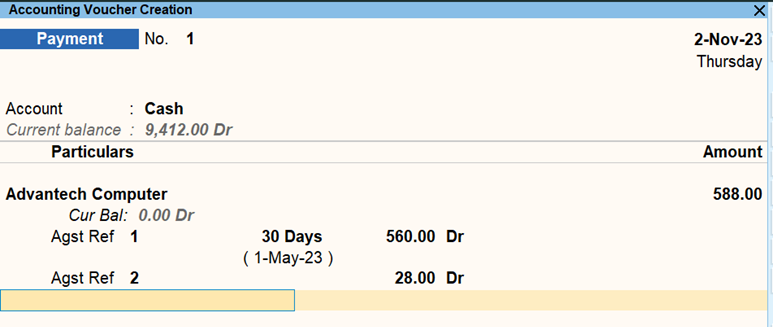

Step 7 Payment Voucher Against bill No

Payment Voucher

That’s all