Tally Prime calculates the tax of all parties/suppliers where TDS deduction is mandatory. It calculates the TDS automatically and prints Form16A certificates, Forms 26Q, 26, 27 and 27A (Cover Note) for Quarterly / Annual Returns as per statutory requirement

It allows the user to view and print various TDS reports, Challans and TDS Outstanding statements.

Important TDS Section List

Example of TDS

Let’s assume that a start-up company pays Rs. 50,000 as rent every month to whoever owns the property. The TDS applicable to the amount is 10%, so the company must subtract Rs. 5,000 and pay Rs. 45,000 to the property owner. In this case, the owner of the property will receive Rs. 45,000 following TDS. The owner can add the gross amount of Rs. 50,000 to his income, thereby allowing him to take credit for the Rs. 5,000 that has already been deducted by the company.

Types of TDS

Here are some of the income sources that qualify for TDS:

• Salary

• Amount under LIC

• Bank Interest

• Brokerage or Commission

• Commission payments

• Compensation on acquiring immovable property

• Contractor payments

• Deemed Dividend

• Insurance Commission

• Interest apart from interest on securities

• Interest on securities

• Payment of rent

• Remuneration paid to the director of a company, etc

• Transfer of immovable property

• Winning from games like a crossword puzzle, card, lottery, etc.

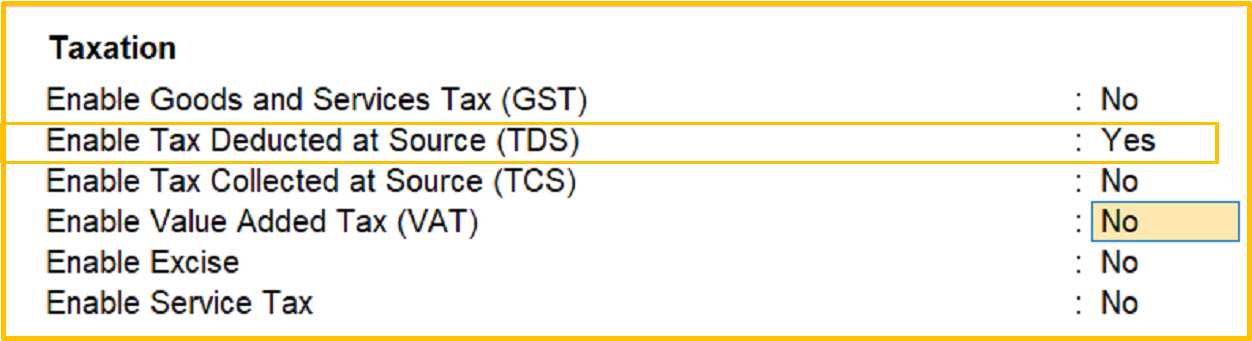

Step 1 Enable TDS by Press F11 key

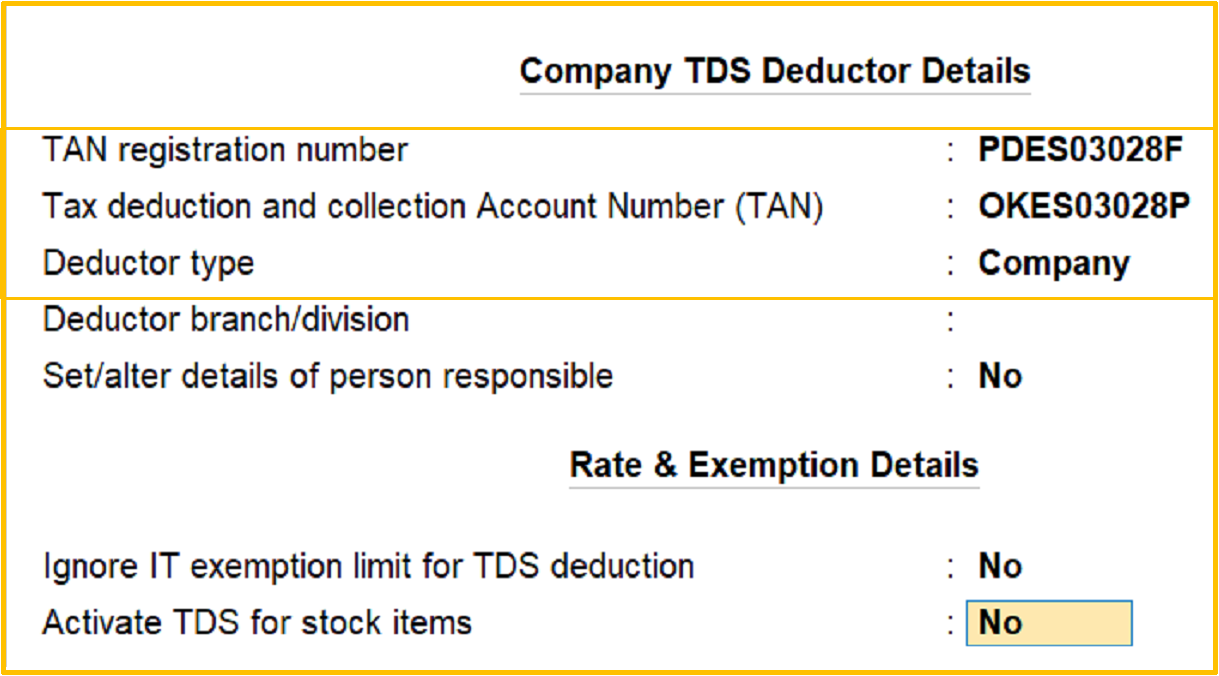

Step 2 Company TDS Diductor Details

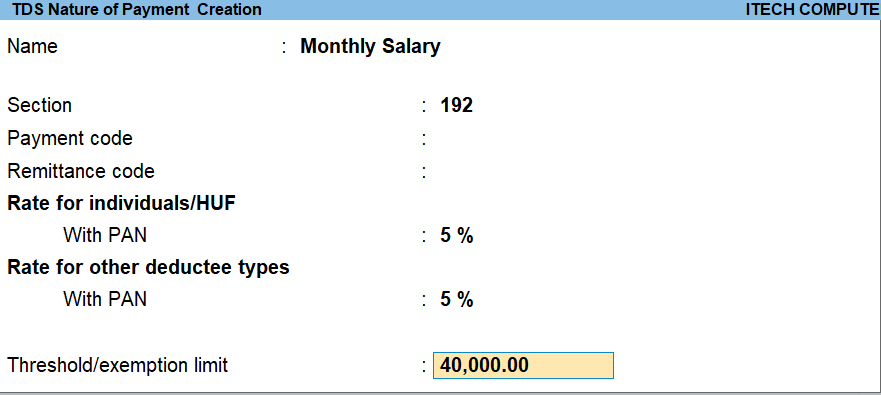

Step 3 Create TDS Nature of Payment

GOT >> Create >> TDS Nature of Payment

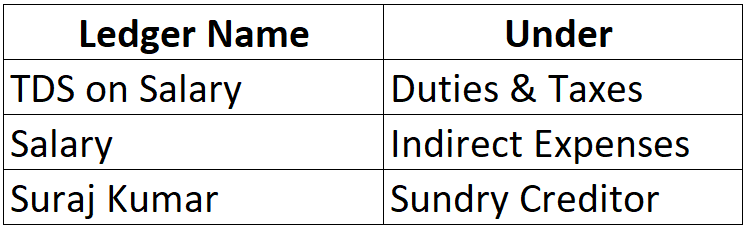

Step 4 Create Following Ledger

Ledger Creation – TDS on Salary

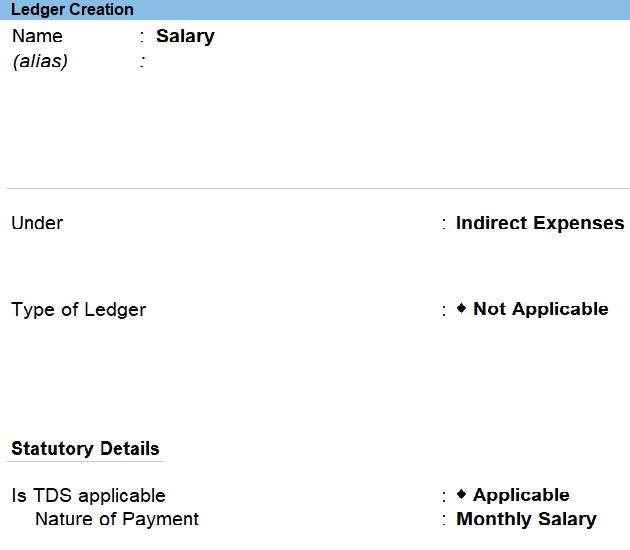

Ledger Creation – Salary

Ledger Creation – Suraj Kumar

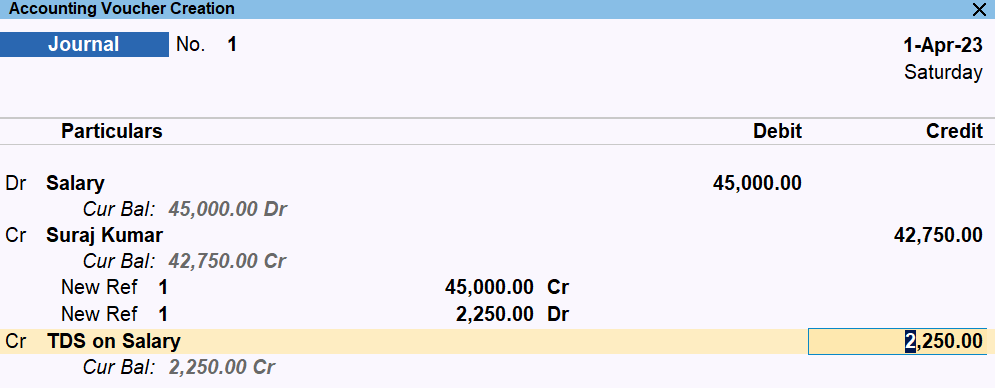

Step 5 Pass Journal Ledger