The payroll work unit refers to the basic unit of measurement used for calculating wages or salaries of employees, It is typically an hour, day, week, or month, depending on the organization’s payroll policies. A unit is used to define the quantity or rate of an employee’s earnings or deductions.

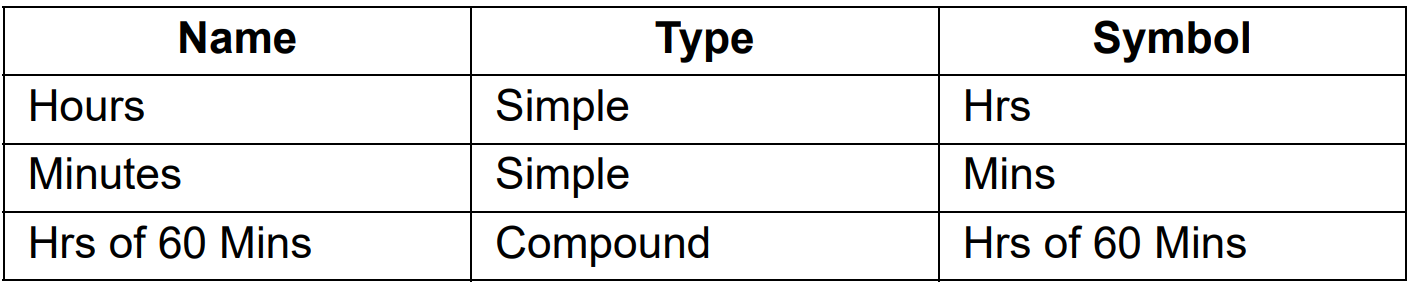

Payroll work units can be classified into two types, Simple Payroll Units and Compound Payroll Units.

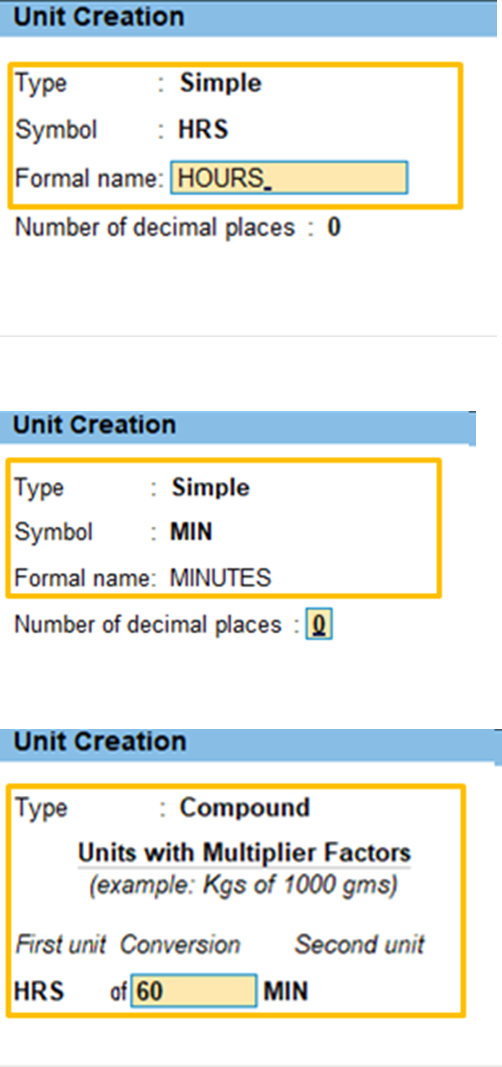

1 Simple Payroll Units refer to individual units such as Day, Week, Month, Hours, Pcs, Box, Nos

etc., Whereas,2 Compound Payroll Units refer to Units which are combination of two simple units,

i.e., an Hour of 60 Minutes, Month of 26 days, Day of 8 Hrs.

1. Hourly-based payroll: In hourly-based payroll, the number of hours worked is used as the unit of calculation. The employee’s hourly rate is multiplied by the number of hours worked to determine the gross pay.

2. Commission-based payroll: In commission-based payroll, the amount of sales made is used as the unit of calculation. The employee’s commission rate is multiplied by the total sales to determine the commission amount.

3. Deductions: Units can also be used to calculate deductions such as taxes, insurance, and retirement contributions. The amount of the deduction is based on the percentage of the employee’s gross pay, and the unit used is the gross pay.

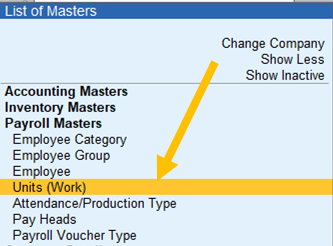

Create Payroll Work Unit?